Real Estate Tax

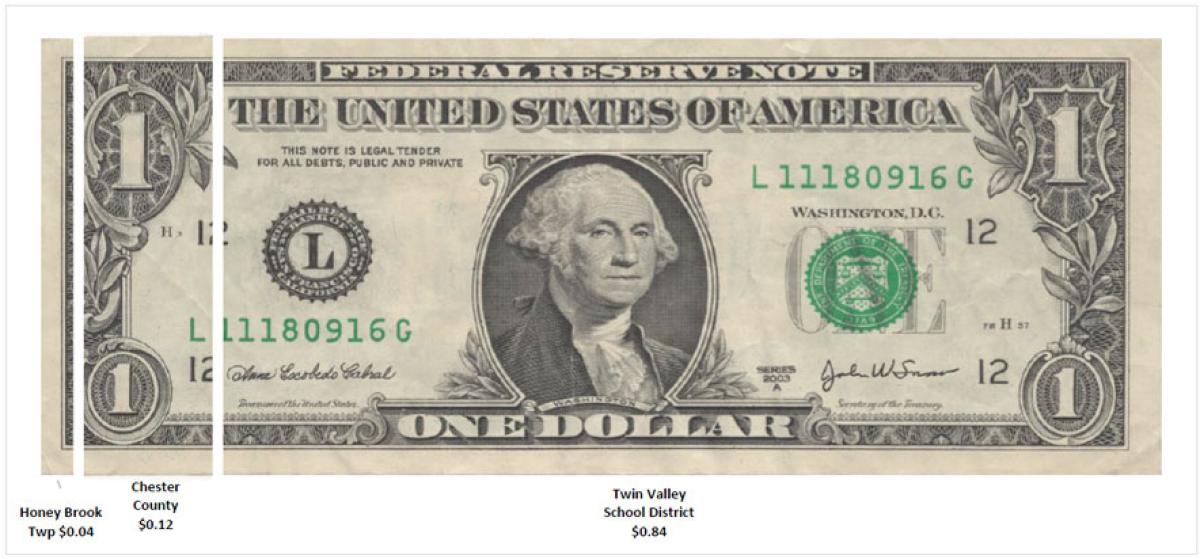

Residents in Honey Brook Township pay real estate taxes to Chester County, Twin Valley School District and Honey Brook Township. The amount of tax that you pay to each of these government units is calculated by taking the millage rate and multiplying it by your property’s assessed valuation. The millage rate is set annually by each of the government units governing bodies while the assessed valuation is set by the Chester County Assessment Office.

Twin Valley School District

The School District collects its own real estate tax. The July 2023 through June 2024 tax rate is 32.4937 mills. Contact the district’s tax office at (610) 286-8632 for information and tax certifications.

Chester County

The Chester County Treasurer collects the County real estate tax. The 2024 tax rate is 4.551 mills. Contact the Chester County Treasurer at (610) 344-6370 for information and tax certifications.

Honey Brook Township

The Chester County Treasurer also collects the Township’s real estate tax. The 2024 tax rate totaling 1.35 mills is divided into three parts as follows:

- General Purpose 0.70 mills

- Fire Protection 0.50 mills

- Emergency Medical Services 0.15 mills

Contact the Chester County Treasurer at (610) 344-6370 for information and tax certifications.

Earned Income Tax

The Keystone Collections Group collects this tax for the Township and the Twin Valley School District. The school district receives 0.5% from this tax. The remaining 1% goes to the Township with 0.5% used for general purposes and 0.5% for the land preservation program. Like State and Federal income taxes, you must file a tax return by April 15th each year. Forms are available by contacting Keystone Collections Group at (610) 269-4402.

Call 1 (866) 539-1100 or visit Keystone’s website by clicking here to file electronically.